- AjoBank is a decentralized SaaS FinTech company based in Lagos, Nigeria, focusing on providing reliable financial services to the unbanked community.

- AjoBank’s B2B2C model connects users in underserved areas to financial solutions through local agents and merchants, filling a significant gap in financial inclusion.

- Through predictive analysis and creditline facilities on AjoBank’s dashboard, agents can enhance their financial operations and services.

In the heart of Lagos, Nigeria, AjoBank is shaping the future of financial inclusion in remote areas. The FinTech startup has developed a Software-as-a-service (SAAS) solution to bridge the gap between unbanked people and reliable financial services, turning local agents and merchants into banking service providers for their community.

AjoBank’s model is a game-changer, especially in regions where traditional banking infrastructure is scant, and many people are excluded from conventional financial services. By equipping agents, mobile money operators, thrift collectors, and merchants with a platform to serve banking needs, AjoBank takes financial inclusion to the doorstep.

What sets AjoBank apart is its successful fusion of technology and human touch. The platform, built on the principles of decentralized SAAS FinTech, allows local merchants to perform functions akin to a traditional bank branch, including money transfer, savings account operation and credit provision. However, the on-ground presence of the agents gives AjoBank a unique edge, allowing users an in-person assistance that can’t be replicated by virtual-only platforms.

Moreover, AjoBank’s dashboard provides agents with an overview of cash flow records, financial statements and analysis, thus fostering clarity and transparency in transactions. Further, the inclusion of a creditline facility empowers agents to make prudent financial decisions.

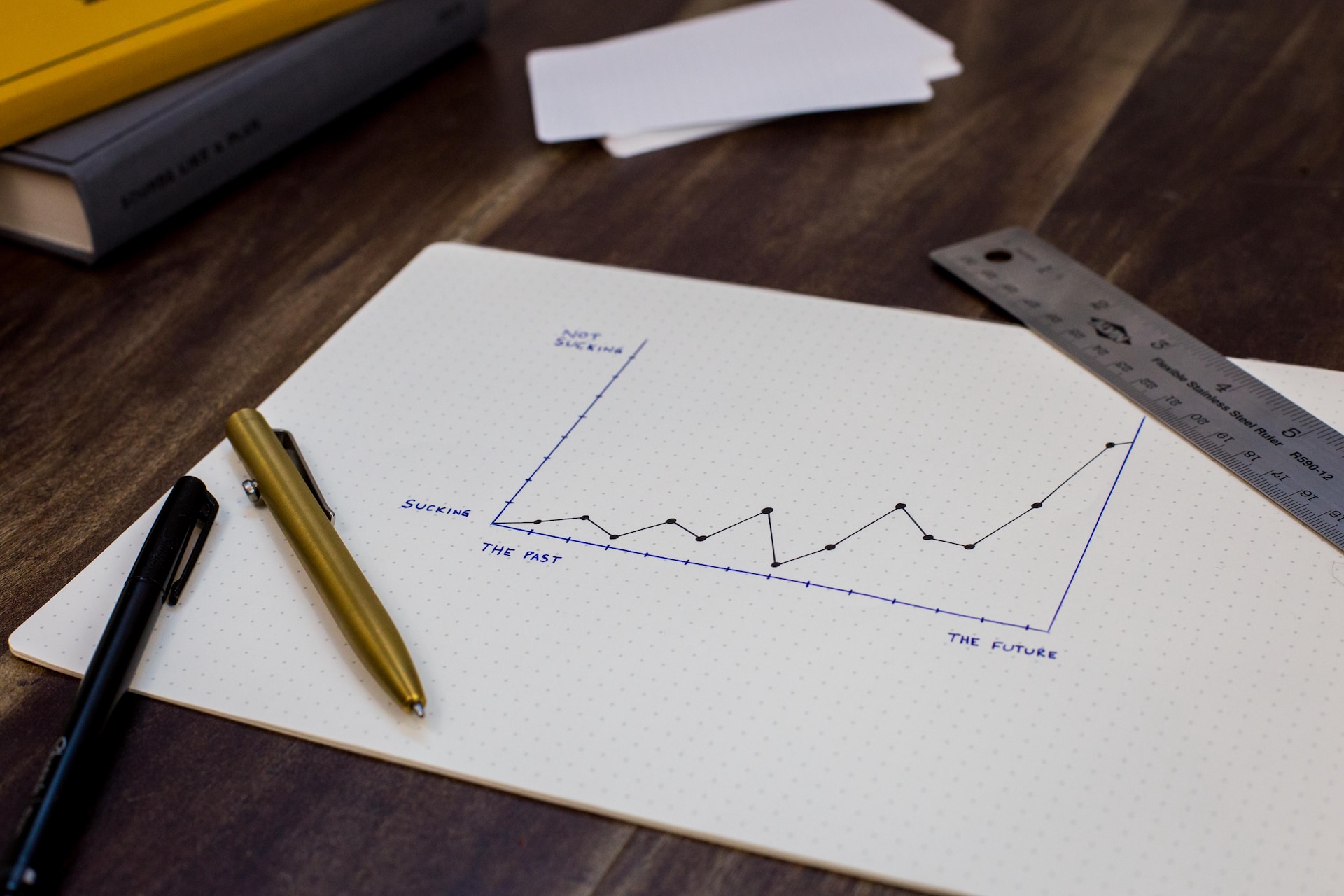

As we look into the future of financial inclusion in remote areas, the role of decentralized SaaS FinTech startups like AjoBank cannot be overstated. By leveraging technology and human networks, these companies are democratizing access to basic banking facilities, thereby fuelling social and economic progress.

Ready to Promote Your Brand with Finance Magazine?

Looking to reach a targeted audience of finance professionals and decision-makers? Finance Magazine offers sponsored article opportunities and partnerships to help you showcase your brand and drive sales. Learn more about our advertising options and reach out to us today! Click here to discuss sponsored articles and partnerships.

Maximize your brand visibility and engage with a highly engaged finance audience. Contact us at [email protected] to get started. Let Finance Magazine be your platform for success!