Introduction:

In an era where technology has transformed countless industries, it’s surprising that property tax management remains archaic and burdensome for homeowners. However, taxProper, a Chicago-based startup, is on a mission to change that. With their cutting-edge property tax management platform, taxProper empowers homeowners to save money on their property taxes and simplifies the appeals process. Discover how taxProper is revolutionizing property tax management and leveling the playing field for homeowners.

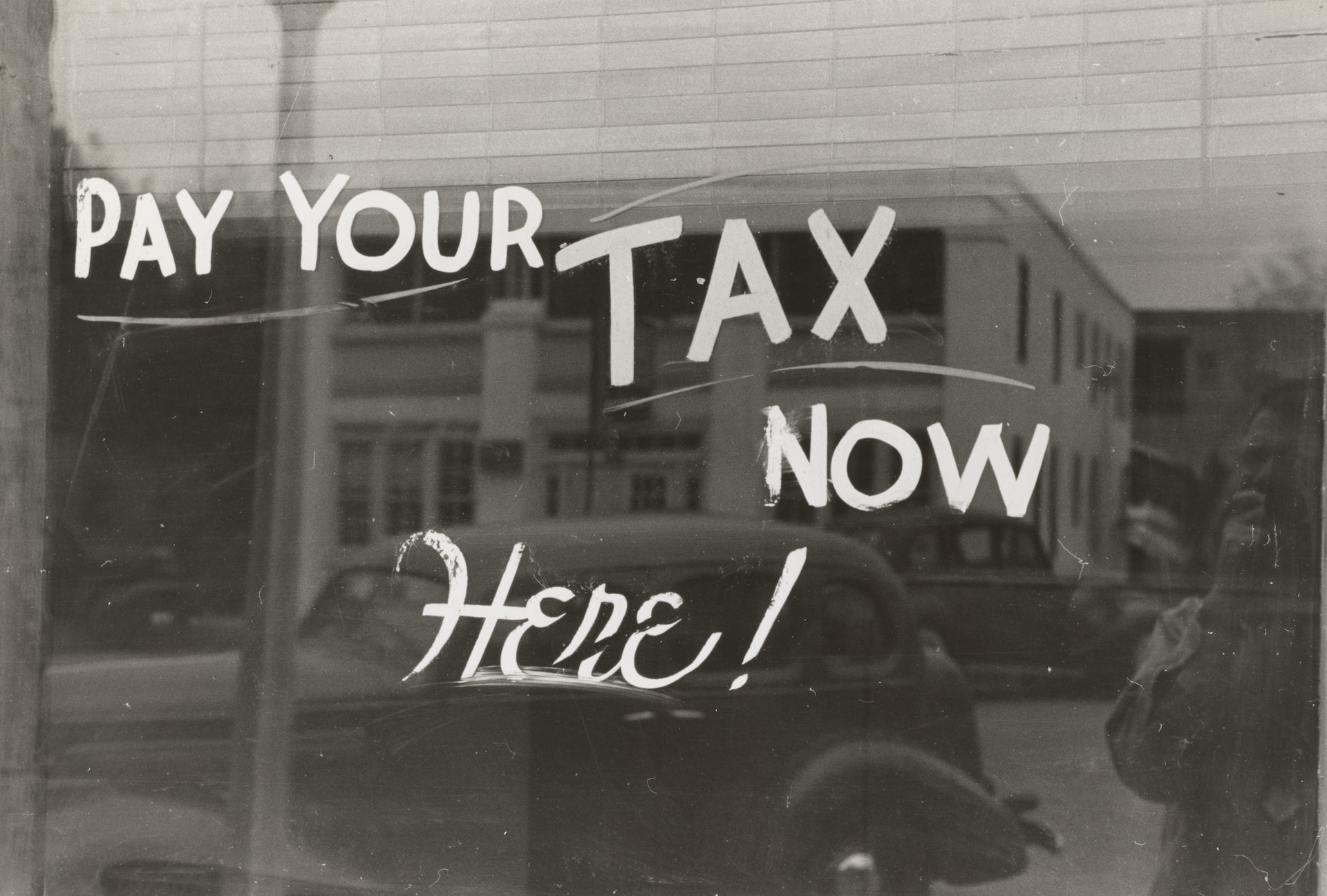

The Outdated Property Tax Assessment System

The technology used by governments to evaluate homes for property tax assessment is plagued with outdated methodologies that often lead to inaccurate valuations. This results in homeowners paying more than their fair share in property taxes. taxProper recognized this flaw and decided to disrupt the industry by providing homeowners with the tools they need to combat this injustice.

Simplifying the Appeals Process

One of the major pain points for homeowners is the complex and time-consuming appeals process. taxProper understands the frustrations faced by homeowners who wish to contest inaccurate valuations but are deterred by the intricacies of the process. With their innovative appeals software, taxProper has simplified the entire process, making it accessible and hassle-free.

Using cutting-edge machine learning techniques, taxProper’s software generates more accurate valuations for homeowners. If a customer is being taxed more than their property’s worth, taxProper’s platform automatically generates an appeal using the collected data, generates the required paperwork, and even files it on behalf of the customer. This seamless process saves homeowners time, money, and the frustration of navigating the appeals process alone.

Empowering Homeowners to Save Money

taxProper believes that homeowners should not be burdened by the inefficiencies of the property tax system. By utilizing their platform, homeowners gain access to a range of tools designed to maximize tax savings. From accurate property valuations to automated appeals, taxProper empowers homeowners to save money on their property taxes effortlessly.

Conclusion:

Thanks to taxProper’s visionary approach and state-of-the-art technology, homeowners no longer need to accept inaccurate property tax assessments or endure the complexities of the appeals process. taxProper has successfully leveraged machine learning and automation to level the playing field, ensuring fair treatment for homeowners.

website at https://www.taxproper.com/

Twitter: https://twitter.com/taxProper

Facebook: https://www.facebook.com/taxProper/

LinkedIn: https://www.linkedin.com/company/taxproper/

Ready to Promote Your Brand with Finance Magazine?

Looking to reach a targeted audience of finance professionals and decision-makers? Finance Magazine offers sponsored article opportunities and partnerships to help you showcase your brand and drive sales. Learn more about our advertising options and reach out to us today! Click here to discuss sponsored articles and partnerships.

Maximize your brand visibility and engage with a highly engaged finance audience. Contact us at [email protected] to get started. Let Finance Magazine be your platform for success!