Goscore is a Norwegian startup that brings human credit scoring to private customers using modern ML technology and data enriched with PSD2 customer transactions. Their solutions and services help banks, insurance, and retail companies make the right credit decisions, personalize existing and develop new products, get more customers without marketing budget changes, and reduce loan default rates.

Fixing the Broken Credit Scoring

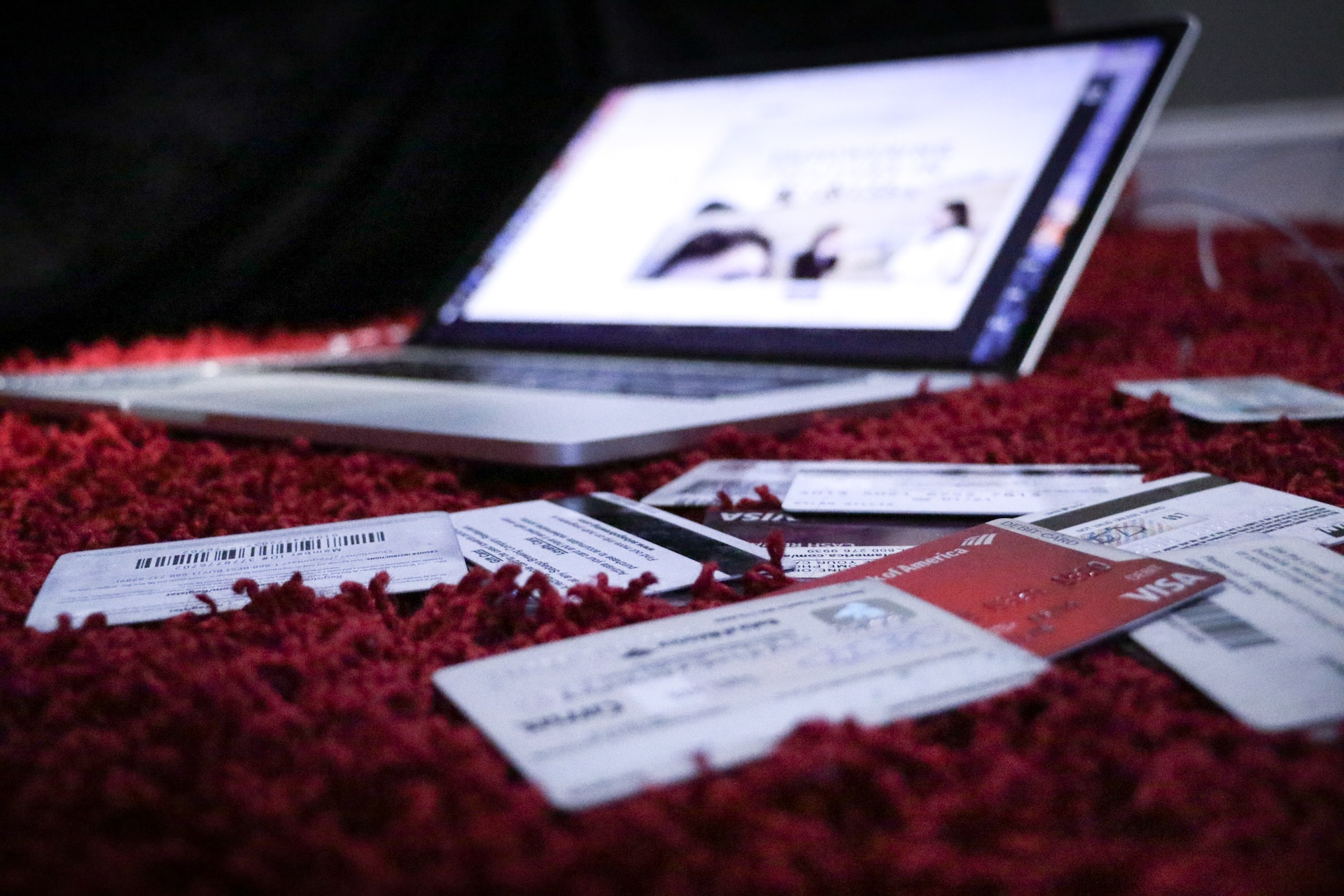

The traditional credit scoring model is based on limited data sources, leading to inaccurate credit decisions, and missing out on creditworthy customers. Goscore aims to fix this broken system by using more data sources and consumer data, with their explicit consent, including PSD2 transactions, Mastercard datasets, Google maps, and various local data sources (structured data), such as business and other public registers. They also use unstructured data, such as LinkedIn profiles, to analyze a consumer’s position in the job market and predict their income and stability.

Better ML Algorithms for Accurate Credit Scoring

Goscore uses better ML algorithms based on decision trees and neural networks to find more complex relationships and correlations between different data points collected to build and analyze a comprehensive consumer profile. This leads to accurate credit scoring, increasing creditworthy customers by as much as 19% while reducing default rates by as much as 49%.

Transparent Credit Scoring for Consumers

Goscore believes in transparent credit scoring and shares the score with consumers and explains it in the simplest terms. They provide consumers with information about why they got this exact credit score, what they could do to make it better, and how it affects their loans and creditworthiness. This makes it easier for consumers to understand their creditworthiness and take steps to improve it.

Partnering with Banks, Leasing Companies, and Retail Stores

Goscore’s first-tier customers include banks, leasing companies, and retail stores. Goscore provides them with hot leads and various data insights about new users for simpler onboarding as well as for existing customers. Their solutions are customer-centric and user-friendly, making it easy for businesses to integrate them into their existing flow.

Conclusion

goscore brings a human credit scoring system to private customers using modern ML technology and data enriched with PSD2 customer transactions. Their solutions and services help banks, insurance, and retail companies make accurate credit decisions, personalize existing and develop new products, and reduce loan default rates. Goscore’s transparent credit scoring model allows consumers to understand their creditworthiness and take steps to improve it.

Website: https://goscore.me

Facebook: https://www.facebook.com/goscoreas

LinkedIn: https://www.linkedin.com/company/goscore/

Ready to Promote Your Brand with Finance Magazine?

Looking to reach a targeted audience of finance professionals and decision-makers? Finance Magazine offers sponsored article opportunities and partnerships to help you showcase your brand and drive sales. Learn more about our advertising options and reach out to us today! Click here to discuss sponsored articles and partnerships.

Maximize your brand visibility and engage with a highly engaged finance audience. Contact us at [email protected] to get started. Let Finance Magazine be your platform for success!