In today’s interconnected digital landscape, cyber threats pose a significant risk to businesses, especially small and medium-sized enterprises (SMEs) that often lack the resources to combat evolving cyber risks. Introducing Cowbell Cyber, a trailblazing startup that is transforming the world of cyber insurance for SMEs. With its innovative approach and cutting-edge technology, Cowbell Cyber is revolutionizing the insurance industry by providing adaptive cyber insurance coverage that evolves with today’s and tomorrow’s threats.

Protecting the Backbone of the Economy: Cyber Insurance for SMEs

Small and medium-sized enterprises form the backbone of the global economy, driving innovation, creating jobs, and fostering economic growth. However, these businesses are often prime targets for cybercriminals due to their limited cybersecurity measures. Cowbell Cyber recognizes this vulnerability and aims to bridge the gap by offering tailored cyber insurance solutions specifically designed for SMEs.

Adaptive Coverage and Continuous Risk Improvement

At Cowbell Cyber, the focus is not just on offering insurance coverage but also on empowering businesses to mitigate cyber risks proactively. By providing adaptive cyber insurance policies, Cowbell ensures that coverage evolves alongside emerging threats. This forward-thinking approach allows SMEs to stay one step ahead of cybercriminals.

Moreover, Cowbell’s policies come bundled with invaluable cyber risk resources, enabling policyholders to continuously improve their cyber risk profile. These resources include access to expert guidance, best practices, and cutting-edge tools to strengthen cybersecurity measures. Cowbell Cyber believes that prevention is better than recovery, and equips SMEs with the necessary tools to prevent cyber incidents in the first place.

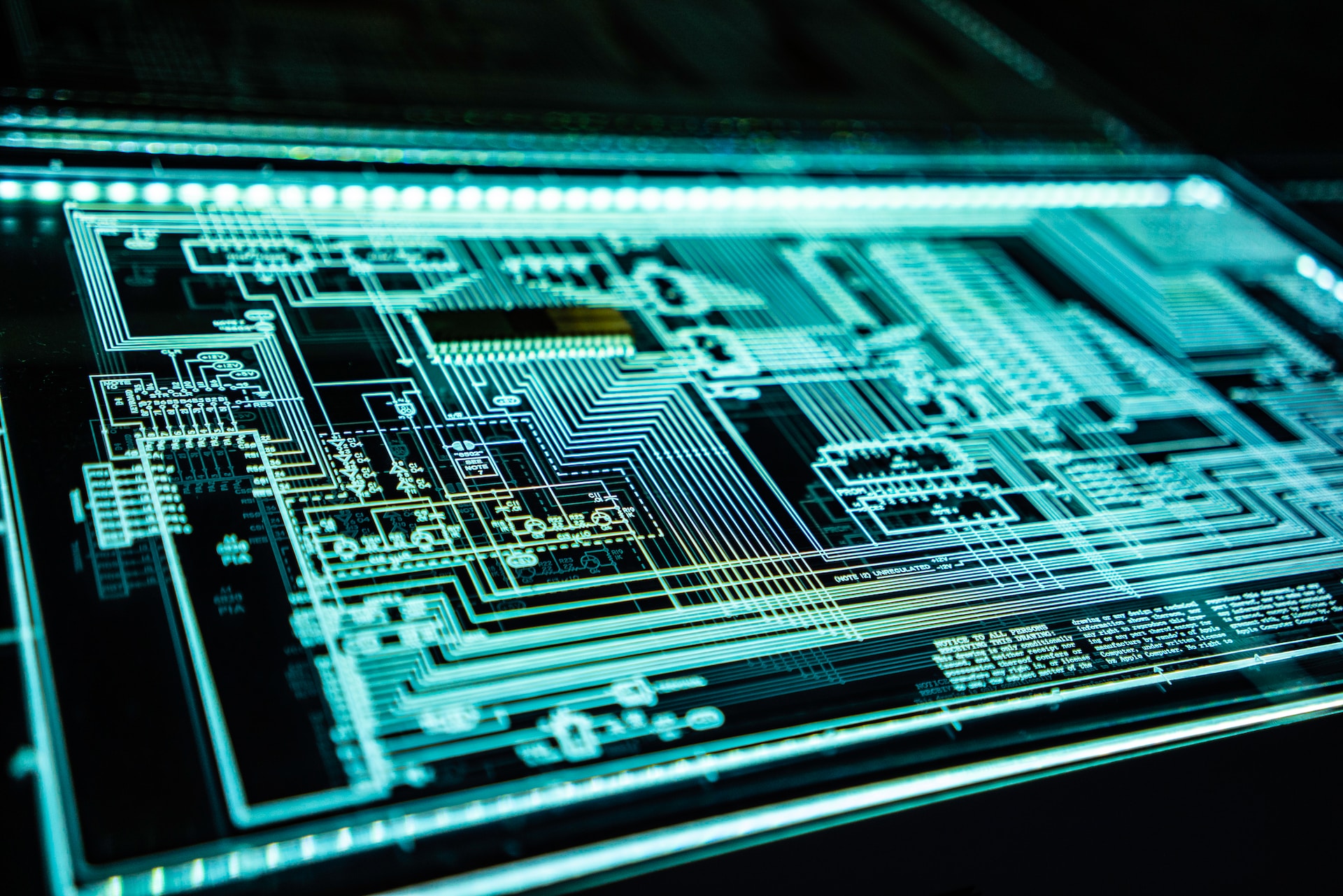

III. Revolutionizing the Insurance Process: AI-Powered Underwriting in Minutes

Traditionally, obtaining insurance coverage could be a time-consuming and complex process. However, Cowbell Cyber has leveraged the power of artificial intelligence (AI) to streamline and expedite the insurance process. Their proprietary continuous underwriting platform, powered by Cowbell Factors, allows for risk selection and pricing to be completed in less than 5 minutes from submission to issue. This breakthrough technology not only saves time but also ensures that SMEs can secure the coverage they need without unnecessary delays.

Conclusion: Securing the Future of SMEs

Cowbell Cyber is paving the way for a new era of cyber insurance for SMEs, empowering businesses with adaptive coverage, comprehensive risk management resources, and lightning-fast underwriting. By bridging the gap between insurance and cybersecurity, Cowbell Cyber is protecting the backbone of the economy and enabling SMEs to thrive in the digital age.

Website: https://cowbell.insure

Twitter: https://twitter.com/CowbellCyber

Facebook: http://facebook.com/cowbellcyber